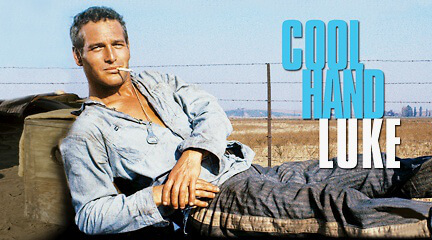

How to be “Cool Hand Luke” during stock market dips

In the movie Cool Hand Luke, Paul Newman’s character Luke says, “Sometimes, nothing can be a real cool hand.” Hence, prompting Dragline (George Kennedy) to nickname him “Cool Hand Luke.”

50 years after this movie was made (yes, 50 years!), this sage advice from Luke can be applied during a stock market dip. While the quote was in reference to Luke’s bluff in a poker game, the concept of doing “nothing” vs. having a knee-jerk reaction and bailing out of the positions in our portfolio, can be a real “cool hand.” History (and Warren Buffet) agree.

Warren Buffett once said: “Be fearful when others are greedy and greedy when others are fearful.” Unsurprisingly, Warren Buffett’s investment advice is well supported by data. Since 1950, the S&P 500 fell by 3% or more on 100 days. In the ensuing year following those drops the S&P 500 generated a 16.8% investment return average. To ease your mind even further, average annual return over the next 5 years following 3% drops in the S&P 500 was 10.8%. Note that these figures are both higher than the average historical 1-year and 5-year returns (8.7% and 7.5%, respectively).

We understand how stock market fluctuations can make us all feel a bit unsettled. But keep in mind that history shows us repeatedly that knee-jerk decisions to sell after markets fall is often not the best decision.

So are you still asking yourself what to do? It’s important to embrace an investor’s mindset and understand that you’ll never be able to control the markets. Investors are more concerned with long-term growth and tend to remain level-headed about future prospects. They prioritize instead things they can control, like how their portfolio is allocated and the fees associated with the said portfolio. Investors get that the markets have various cycles and they ride out those cycles staying the course. My mother has always said, life is 20% what happens to you and 80% how you react to it. How are you going to react?

For people 5 years out from retirement or just retiring, however, rather than doing absolutely nothing we do suggest that you take a look at the allocation of your portfolio between stocks, bonds, and annuities. A stock market dip or correction in an otherwise long bull market is a “gentle” wake-up call to evaluate the aggressiveness of your portfolio. A dramatic downturn today or sometime in the future could have a severe effect on the long-term survivability of retirees’ portfolio.

The raging bull market since 2009 has made investors feel impervious to the inherent volatility of the stock market. This week’s market dip could be a quick market correction or the beginnings of the next bear market. In either case, it’s important to equip your investment plan with durability and pliability, and consider adding in some hedges against volatility such as a fixed indexed annuity.

A strategy that incorporates this hedge with stocks and bonds could offer individuals (5 years out from retirement or just retiring) a potentially better risk/return portfolio.

Conventional wisdom today is that retirees should invest in a traditional portfolio of stocks and bonds. However, recent research indicates that the portfolio with higher risk or volatility will have a shorter life expectancy when taking income vs. a portfolio with lower volatility generating the same returns. Research also indicates that the safe withdrawal rate from this traditional 60/40 stock/bond portfolio has dropped to 2-2.5% providing for a 3% per year inflation adjustment (based on current market conditions and the bond market). Something might need to change.

The Annuity Advantage

Fixed Indexed Annuities (FIAs) can be an effective alternative to a stock/bond portfolio. As evidenced by the research report, Real-World Indexed Annuity Returns by David F. Babbel, phD, professor at Wharton School, U. Penn. Dr. Babbel analyzed actual fixed indexed annuity contracts between 1997-2010 and concluded, “the real world indexed annuities analyzed in this paper outperformed the S&P 500 index over 67% of the time, and outperformed a 50/50 mix of one year treasury bills and the S&P 500 79% of the time.”

The interesting fact about FIAs is that they offer absolute guarantee of principal. In addition, in, an economic downturn such as 2007-2009 when the stock market was down more than 40% and a 50/50 portfolio would have been down more than 20%, the same FIAs at worst offered a 0% return during these same timeframes.

Individuals within 5 years to retirement or in retirement typically use bonds to reduce volatility in their portfolio. However, with the low interest rate environment over the last 5 years, having a 50/50 stock/bond portfolio could hurt retirees long term. As an example, 10 year U.S. government treasuries had a return of .84% over the past 5 years. For this reason, it’s imperative to find viable low risk alternative to traditional government bonds in light of the current economic environment.

There are some advisors and individuals attempting to use below investment grade bonds (junk bonds), senior bank loan funds, and convertible bonds in an attempt to get additional yield from their bond portfolio. This could ultimately backfire as these types of investments all suffered 20+ percent losses in 2008. As well, there are tactical asset allocation strategies that attempt to increase returns, but once again these alternatives suffered significant losses in 2008 and are not suitable to the US treasury bond.

We’ve witnessed many people throwing caution to the wind due to the stock bull market we’ve had since April. 2009. We’ve witnessed people very close to retirement wanting to keep high stock exposure in their portfolios. We recommend age appropriate portfolio allocations to assure one is properly invested in the event of a major stock market correction or potential bear market, either of which could be on our horizon.

At Your Retirement Advisor, we recommend an “unconventional” retirement portfolio that is made up of high quality guaranteed fixed indexed annuities, globally diversified stocks and bonds. We create a higher potential growth rate and lower portfolio volatility as a result. Our research (and experience working with retirees), along with additional research from Morningstar and Nationwide indicates that this unconventional portfolio decreases volatility and offers higher growth potential which has the effect of increasing the safe withdrawal rate back to Bengen’s 4% rule or higher, with a 3% inflationary increase per year. Our white paper, The New Portfolio for a Changing Economy explains this unconventional, but effective and efficient strategy for retirees in more detail.

Unfamiliar with the “Four Percent Rule”?

In 1994, financial advisor William Bengen found that he was skeptical of the traditional consensus that 5% was generally considered a safe amount for retirees to withdraw from a retirement account each year in their retirement. Using historical data on stock and bond returns over a 50-year period between 1926 and1976 with an emphasis on severe market downturns in the 30s and early 70s, Bengen concluded that no historical case existed in which a 4% annual withdrawal exhausted a retirement portfolio in less than 33 years.

Considering that the investment landscape since 1994 has changed dramatically, the website Work + Money sought out financial advisors to get their take on whether or not this rule of thumb should still be considered the “safe withdrawal” rule, including YRA’s very own, Brian Saranovitz.

Brian concludes in the article that the 4 percent rule may not work in today’s markets if people follow the traditional recommendation of a portfolio made up of 60% stocks and 40% bonds. He explains that because bond yields are at a historic low, 4 percent will end up burning through the portfolio too quickly. For safety, he recommends an annual draw of 2-3 percent. Retirees looking to withdraw 4 percent each year may want to consider a combination of stocks and fixed indexed annuities, Brian advises.

“Here at YRA, we have developed such a plan, which we call a ‘Multi-Discipline Retirement Strategy,’ which includes a portfolio of globally-diversified stocks and annuities. It’s a combination critical as one approaches retirement,” Brian tells Copeland. “It should also be coupled with a systematic withdrawal income plan and a buffer strategy in times of severe stock market losses.”

Brian goes on to outline several risk factors that impact portfolios and make the 4 percent rule unfeasible. Longer-than-expected retirements are becoming the norm as longevity rates increase. As Brian explains, “The problem specifically with living too long is inflation. In other words, in the present, a person is saving money for a future in which the prices of goods and services will have risen and the purchasing power of the consumer will have declined.”

To combat this problem, Brian advises that retirees need to reconsider portfolios that shortchange stocks for the supposedly safer world of bonds in their retirement portfolios. Due to the fact that historically stocks have been the only investment that have outpaced inflation, YRA urges investors to consider a diversified portfolio to offset the volatility that is inherent to stocks.

To minimize the second retirement risk factor listed, volatility, Brian recommends utilizing standard deviation to observe the deviation of a portfolio from the average rate of return from year to year. The higher the standard deviation, the higher the volatility and the higher the volatility, the greater the risk of portfolio failure in retirement.

While we cannot completely control sequence of return, the third risk factor featured, Brian expresses that investors can protect themselves from this type of risk by establishing a “safe bucket” of funds to withdraw from in the event of market downturn. In addition to keeping their principal stocks while waiting out the market correction, there is also research that proves this action has psychological benefits which can prevent panic and the sale of stocks when the market dips.

“A proper buffer can consist of life insurance cash values, a reverse mortgage reserve account, cash or CDs, a guaranteed annuity, or any other account that will have a limited effect when there is a stock market downturn,” Brian adds in conclusion.

The market is something we can’t control, so we suggest as an investor you focus on the things you can control, sit tight and ride it out. Or, if you’re closing in on retirement, consider how aggressive your portfolio is and make some adjustments to protect it from stock market volatility. This way, the next time there is a dip or downturn, you can be Cool Hand Luke.

Sources:

-The Retirement Killer: Volatility , Frank Armstrong III, Forbes Magazine, Dec 6, 2013

-Does Your Portfolio Have Too Much Interest Rate Risk?, Allianz, 9/2013

-Jack Marrion, Geoffrey VanderPal, David F. Babbel, Index Compendium

-The 18 Risks of Retirement Income Planning, American College of Financial Services

-Investopedia